The Nan Market Report

The Houston housing market continued easing its way to pre-pandemic levels. August is now the fifth straight month of declining sales and rising inventory. Single-family leases rose dramatically, signaling that consumers are now shifting to the rental market. As a result, the housing inventory is now at its highest level in two years.

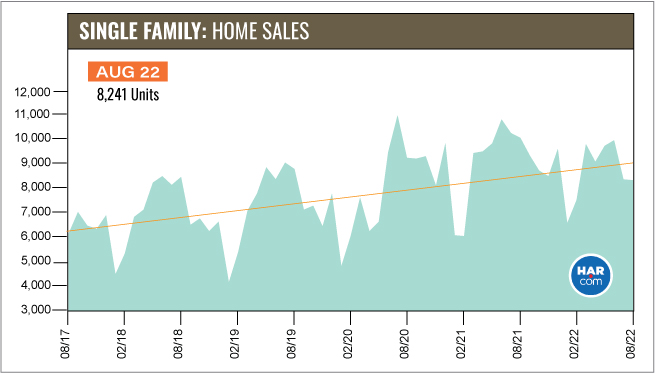

Home Sales Data

Single-family home sales fell to 16.9% in August, making it the lowest one-month sales volume since February 2022. Currently, 2022 is trailing 2021's sales volume by 3.7%.

All price point segments suffered negative sales in August, except homes priced between $500K-$1M, which rose by 10%. Homes below $250K are extremely low in inventory, with many consumers making a shift to the lease market as a result.

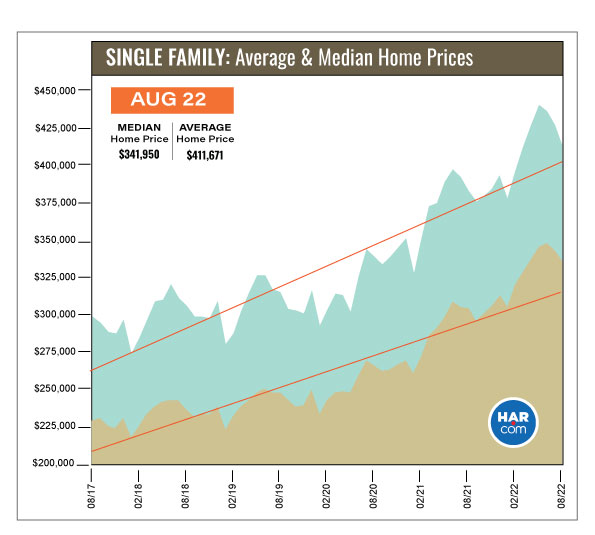

Average Home Price Data

Single-family home prices averaged approximately $411K, an 8.7% increase from July, while overall home sales fell by 16.9% compared to last August.

However, with the anticipation of rising interest rates and rising home prices, fewer and fewer buyers are paying above list price for homes, making June the last month that Close-To-List-Price ratios were over 100%.

So What Does This Mean?

This slow cooling-off period is leading to an increase in months of inventory, which now sits at 2.5 months, the highest it has been in two years. Days on Market figures increased from 27 to 31 days. Despite these slight shifts in the market, this is still considered a seller’s market and there is still plenty of opportunity to enter the market as a seller.

If you are curious about statistics in your area, reach out to one of our incredible agents today for an in-depth analysis of your neighborhood’s market conditions!